CFNEWS Article BY AURORE BARLIER Published on 18 Oct 2021 at 10:15

With 85% of its €90m in revenues generated in France, what could be more natural for Portuguese company Gardengate than to choose a team based in the Hexagon to accompany it in its new growth phase. After two years in the portfolio of its compatriot Crest Capital, the aluminium doors manufacturer has joined Equistone. Equistone, selected after a competitive process organised by the Portuguese teams of PwC, acquires a stake of about two thirds of the capital, alongside the founder and management. The fund is intervening here via its Equistone VI vehicle, which, with an investment of almost 50%, would inject equity in the middle of its range (between €25 and €200 million) in this transaction. The former majority shareholder will reinvest a portion of its proceeds to retain a minority stake. This LBO bis is completed by a unitranche debt provided by Eurazeo IM (ex-Idinvest), with the support of the Portuguese private debt fund Tresmares Capital.

Conquering Europe

Founded in 1997 in Braga under the initial name Porta XXI, Gardengate distributes its products (gates, fences, shutters, fences, etc.) under the Portadeluxe, Greendoor and Friday Courage brands, mainly through DIY stores. This distribution channel has naturally led to a strong presence in France, which is “by far the largest European market for aluminium closures,” say Equistone partners Grégoire Châtillon and Thierry Lardinois. And the group of 600 employees led by its founder, Adelino Costa, now intends to diversify its geographies by relying on the European network of its new majority owner (represented in the Netherlands, England, Paris and Germany). The aim is to increase its presence in areas where it is not very present, such as the Benelux countries, Germany and the United Kingdom – markets that are less mature than France and which offer significant growth potential. In this context, Gardengate will be able to capitalize on the natural geographic expansion of its partner DIY stores, and will support it with new online offerings and expanded product lines.

18% annual growth

In addition to these commercial developments, the company intends to consolidate its local production units – of which there are currently nine – onto a single site in order to increase its production capacity and improve its profitability. All this in a context of continued growth, averaging 18% per year between 2016 and 2021. “Despite supply difficulties and the closure of certain DIY stores during the lockdowns, the company continued to grow in 2020, thanks in particular to the importance that individuals have placed on their living environment since the crisis,” say Grégoire Châtillon and Thierry Lardinois, adding that the planets seem to be fully aligned to continue this dynamic: “Aluminium products continue to take market share from wood, PVC or steel products. At the same time, distribution via online channels and DIY stores is gaining ground on installers,” the investors continue, commenting on a sector they know well having accompanied La Toulousaine between 2010 and 2015 (see below).

The stakeholders in the GARDENGATE transaction

- Target company: GARDENGATE

- Buyer or Investor : EQUISTONE PARTNERS, Grégoire Châtillon , Thierry Lardinois , Jérémy Mathis , Valérian Fleury , FOUNDER(S), Adelino Costa , MANAGERS

- Transferor : CREST CAPITAL PARTNERS, FOUNDER(S), Adelino Costa , MANAGERS

- Acquirer Investment banker / M&A advisor : BANCO FINANTIA

- Business lawyers Financing: GOODWIN, Adrien Paturaud , Laurent Bonnet.

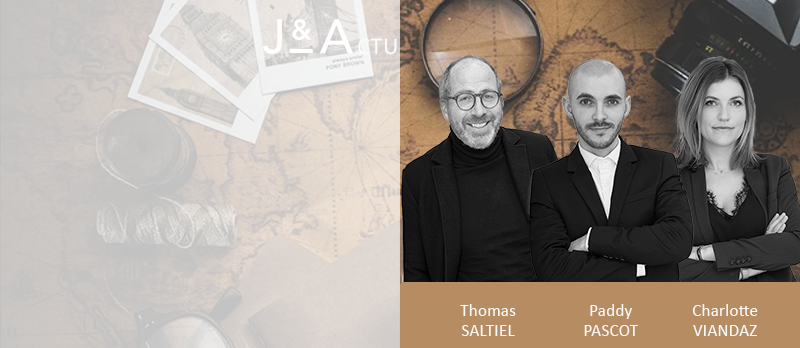

- Competition Lawyer: JOFFE & ASSOCIES, Olivier Cavézian , Klara Matous

- DD Legal and Tax: GOODWIN, Thomas Maitrejean , Marie-Laure Bruneel , Simon Servan-Schreiber , Arthur Deschamps , CMS RUI PENA & ARNAUT

- DD Financial : EIGHT ADVISORY, Stéphane Vanbergue , Christophe Puissegur , Julien Roux.

- DD Strategic : ROLAND BERGER, Ambroise Lecat , Sébastien Murbach , Matthieu Daumas , Mouhsine Aguedach

- Transferor Investment Banker / M&A Advisor: PWC CORPORATE FINANCE

- Transferor Corporate lawyer: GARRIGUES

- Legal and tax advisor: GARRIGUES

- VDD Financial: KPMG TS

- Transferor Strategic advice: LEK CONSULTING, Serge Hovsepian , Maxime Julian

- Debt: TRESMARES CAPITAL

- Debt Unitranche: EURAZEO IM (EX IDINVEST PARTNERS), Maxime de Roquette Buisson

- Debt Lawyer: MAYER BROWN, Patrick Teboul

- Financing Counsel: MARLBOROUGH PARTNERS, Romain Cattet , Philippe de Courrèges