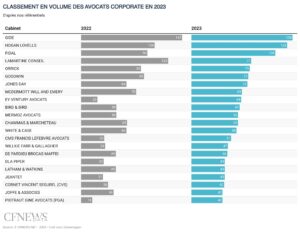

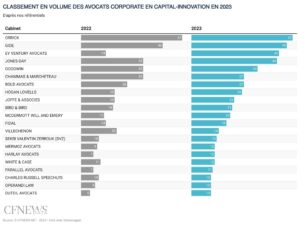

Read the original CFNews article here.

Objectif CRPE, specializing in preparation for the competitive examination to become a schoolteacher, is spinning off Cartesia Education with the assistance of Capza Transition, which is acquiring control and plans to value the company at between 20 and 30 million euros. Joffe & Associés (Emilie de Vaucresson) advised Cartesia Education, alongside 8 Advisory Avocats and Amala Partners.

CAPZA acquires a majority stake in Objectif CRPE, leader in online preparation for the school teacher recruitment exam. Objectif CRPE is recognized for its excellence in preparation for the Concours de Recrutement de Professeur des Écoles (CRPE), offering a comprehensive and flexible online platform, interactive teaching expertise and a CRPE pass rate of 80%, well above the national average of around 35%.

Cartesia Education, under the management of Benjamin Charignon and Aimery de Vaujuas, has established itself as a leader in the professional training market. As a result, 400 teachers and examiners deliver live and replay courses, offer practice for the written and oral exams, and mark papers, all via the internet. Founded in 2017 with the specific aim of training people in retraining for the competitive examination, this SME has recently expanded its offering with “Passion Pédagogie “designed to support young teachers in their first jobs, today recording sales in excess of 7 million euros.

“As Eugénié Hériard-Dubreuil and Martine Depas, respectively CEO of Objectif CRPE and associate lawyer at Amala Partners, explain, “In addition to strong growth in our core business, the company can fuel its development by positioning itself in other state examinations, accelerating its development in continuing education, and pushing ahead with a dedicated offering for students, once the reform has been ratified.